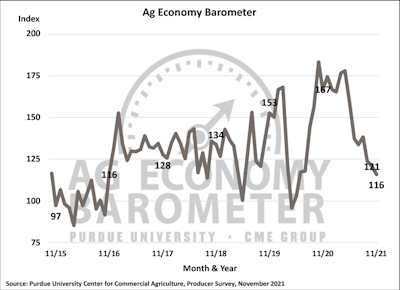

The Ag Economy Barometer slipped to a reading of 116 in November, down 5 points from October and 30% lower than in November 2020 when the barometer stood at 167.

Once again, weakness in the barometer was tied to weaker sentiment regarding current conditions as well as weaker expectations for the future.

Although farmer sentiment weakened slightly in November, the Farm Financial Performance Index rose slightly on the strength of strong crop cash flows in 2021.

Looking ahead, producers are concerned about rising input costs with 55% of producers saying they expect input prices to rise 12% or more in the upcoming year, up from 33% who felt that way in October.

Supply chain constraints, combined with concerns about costs, continue to make this a challenging environment for large capital investments as the Farm Capital Investment Index declined 7 points to its lowest reading since April 2020.

Strong cash flows in 2021 combined with low interest rates continue to make farmers optimistic about farmland values as both the short-term and long-term farmland value indices remain near their all-time highs. Just over half of corn-soybean producers in November said they expect farmland cash rental rates to rise in 2022 compared to 2021.

A breakdown on the Purdue/CME Group Ag Economy Barometer November results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at purdue.ag/agcast.