As the agricultural sector navigates through evolving challenges, ag labor issues have surfaced as a critical factor influencing the landscape of farming practices, food production and animal feed production.

The U.S. Department of Labor’s (DOL) Bureau of Labor Statistics (BLS) projects overall employment of agricultural workers will decline 2% from 2022 to 2032.

However, in the same period, an average of 115,700 job openings for agricultural workers are projected each year. These openings are expected to result from the need to replace workers who transfer to other occupations or retire from the labor force.

The importance of understanding agricultural labor supply, the anatomy of agriculture labor shortages, and solutions to sustained employment is paramount, as the agricultural workforce is vital to feeding a growing global population.

Historical and current labor trends

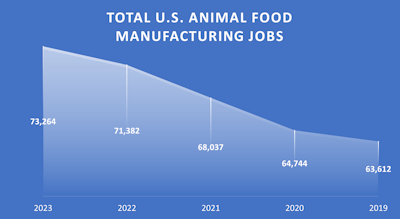

Despite the projected slight decline in agricultural employment overall, the animal feed manufacturing sector has witnessed a significant increase in employment, rising 15% nationwide since 2019, according to the BLS. This growth, illustrated in Figure 1, reflects the expanding employment role of this sector.

The landscape of the animal feed manufacturing workforce is geographically diverse. According to the BLS’s Quarterly Census of Employment and Wages, annual average employment for the United States in total is 73,264, with the states leading in employment contributions spanning nearly coast to coast (California to Pennsylvania). The states in Table 1 represent roughly 50% of total average annual employment for the animal feed manufacturing sector in the United States in 2023.

The American Feed Industry Association (AFIA) highlighted in its 2023 Economic Contribution of the Animal Feed and Pet Food Manufacturing Industries report, prepared by Decision Innovation Solutions (DIS), that the industry sustains direct employment and supports a substantial number of related jobs across the United States, with significant contributions from licensed medicated and non-medicated feed mills.

DIS’s analysis revealed the sector directly employs an estimated 47,380 jobs, with Texas leading in employment figures among states. Figure 2 shows the top 10 states in 2023 for direct employment of animal feed manufacturing industry jobs.

Additionally, the animal feed manufacturing sector contributes an estimated 475,861 jobs within and related to this sector. Figure 3 illustrates the estimated contributions of the top 10 states for employment within and related to the feed industry. Texas, with its 647 feed mills, contributes the most to this figure by generating more than 41,000 jobs.

This underscores the animal feed manufacturing industry’s role as a major employer, particularly in states with a high concentration of feed mills. The report further indicates the critical role of feed facilities in bolstering the national economy

Employment related to the production of byproducts and co-products for animal feed production, such as soybean meal or wheat midds, has seen relatively steady employment and even growth in parts of the United States.

The BLS provides data on the number of employees by state for all industries, including the sector categories postharvest crop activities (excluding cotton ginning), grain and oilseed milling, wet corn milling and starch manufacturing, and soybean and other oilseed processing.

The U.S. total annual average employment for these sectors combined in 2023 was 172,675, up 5% from 2021, according to BLS’s Quarterly Census of Employment and Wages database. Postharvest crop activities make up half of the employment in these categories, with grain and oilseed milling contributing about 37%.

Table 2 highlights the annual average employment in the combined aforementioned categories from 2021 to 2023 in states with sizeable contributions to the production of U.S. corn, soybeans or wheat.

Employment projections and trends

The agricultural labor market, particularly within the animal feed manufacturing sector, is poised for continued growth and is expected to maintain its trajectory due to the rising global demand for protein.

The DOL funds the Projections Managing Partnership (PMP), an integrated, nationwide program of state and local labor projections to help industries make informed decisions based on reliable occupational outlooks.

According to PMP, the total U.S. projected employment outlook for agricultural workers differs by occupation (Table 3).

Although the demand for crops and other agricultural products is rising, the projected growth for certain types of workers is minimal (like agricultural workers, all other at 1.8% growth) due to the adoption of automation and data analytics that will boost productivity and efficiency.

Highlights in state projections

The DOL’s O*NET Online reveals significant employment trends by state for a range of agricultural occupations. Long-term state employment projections are for the period 2020-30. Highlights include:

- High growth states: Colorado (27%), Tennessee (27%) and Oklahoma (14%) show significant growth, indicating potential for more job opportunities and possibly increased agricultural activities or innovation in these regions.

- Moderate growth states: California (8%), Michigan (6%), Nebraska (4%) and Iowa (3%) show moderate growth, suggesting steady, though not explosive, development.

- No growth: Ohio shows no growth, indicating a stagnant but stable employment outlook.

The agricultural industry’s resilience, particularly within the animal feed manufacturing sector, exemplifies the dynamic interplay between labor market shifts, technological integration and demographic changes. Examining employment data and trends sets the stage for strategic planning and informed decision-making for business in these sectors.