The U.S. animal food industry is more than a behind-the-scenes operator, it is a driver of innovation and resilience and a vital contributor to rural economies and the broader agriculture industry. The Institute for Feed Education and Research (IFEEDER), driven by its mission to advance understanding and trust in a sustainable feed and pet food supply chain, believes credible data helps tell that story.

With shifting expectations from consumers, regulators and corporate stakeholders, understanding the scale and diversity of the ingredients flowing through feed and pet food supply chains has never been more important. IFEEDER recently released two reports: one analyzing national ingredient consumption trends across nine livestock, poultry and aquaculture species, and the other highlighting the scale, both in ingredients used and economic contributions, of the pet food industry. These insights help business leaders and decision-makers across the value chain understand consumption trends and quantify and clearly communicate the depth and breadth of the animal food industry.

Ingredient trends

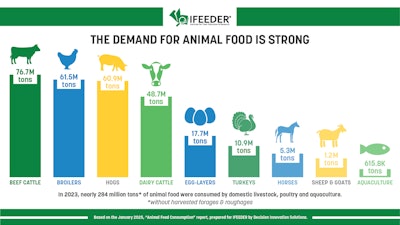

In 2023, livestock, poultry and aquaculture species across the United States consumed an estimated 283.6 million tons of feed. This figure reflects the demand from nine major species, with beef cattle consuming the most at 76.7 million tons, followed by broilers at 61.5 million tons, hogs at 60.9 million tons, and dairy cattle at 48.7 million tons. Egg-laying hens, turkeys, horses, sheep and goats, and aquaculture species made up the remainder.

The report also examined more than 70 unique feed ingredients, highlighting the diversity and complexity of modern animal nutrition. By volume, corn led the list at 159.4 million tons, followed by soybean meal at 35.4 million tons, corn distillers’ dried grains at 32.6 million tons, and smaller, but still significant quantities of, wheat middlings at 5.6 million tons, and canola meal at 5.2 million tons. In ruminant diets, feed is often complemented by harvested forages and roughages, such as corn silage, alfalfa hay and wheat straw. These additional inputs totaled an estimated 267.4 million tons.

Importantly, the data also shows that more than one-third (37%) of feed consumed came from “circular ingredients,” or coproducts and byproducts from other sectors that might otherwise be discarded. Through working with local bakeries, food processors and ethanol facilities, and in compliance with highly regulated processes, the animal food industry turns those products into safe and nutritious animal feed. This data demonstrates the industry’s role in reducing food waste and its commitment to supporting downstream customers (i.e. livestock producers and consumer product goods companies) in achieving their sustainability goals.

Pet Food Report key takeaways

In 2024, U.S. pet food manufacturers produced 9.8 million tons of dog and cat food, driving an estimated $51.7 billion in retail sales. Behind those numbers lies a sophisticated blend of more than 600 plant- and animal-based ingredients, formulated to meet the nutritional needs of millions of companion animals across the country. This report used a reverse engineering model to quantify the ingredients used without revealing proprietary company recipes.

Dry dog food dominated in volume and value, reflecting a wide range of breed sizes and dietary needs. In 2024, dry dog food alone accounted for 5.4 million tons, or 55% of total pet food volume, with an estimated market value of $19.7 billion. Other product segments included dry cat food at 1.6 million tons (16%), dog treats at 1.1 million tons (11%), and wet dog and cat foods, which together made up 17% of volume. Though smaller in weight, cat treats still represented 1% of total tonnage.

Overall, chicken-based ingredients were the most used by weight, totaling 2.2 million tons, and marine ingredients led in value, totaling $3.5 billion. Marine ingredients saw a 95% increase since 2019, signaling growing consumer demand for high-value proteins. Other significant trends included a 34% increase in meat and poultry ingredients, with only water and animal protein meals and fats showing a decline. Alongside the top ingredients like chicken-, beef- and marine-based products, dogs and cats consume an array of grains, legumes, fruits and specialty ingredients. In 2024, corn was the leading plant-based input, peas the most used specialty ingredient, soybean meal the top legume and cranberries the most common fruit used in dog and cat food recipes.

Beyond its role in providing safe and healthy food, the U.S. pet food industry is also a powerful economic contributor, particularly in rural communities. In 2024, pet food manufacturers across 43 states purchased $13.2 billion in farm products to produce 9.8 million tons of dog and cat food. These purchases generated ripple effects throughout the agricultural economy, supporting local farmers, feed processors and service providers. States including Missouri, Kansas, Pennsylvania, Iowa and California led in farm-level purchases, demonstrating how pet food production helps sustain rural livelihoods, reinforcing demand for domestic crops and animal products, and strengthening the agricultural value chain from the ground up.

Similar to the feed ingredient consumption report, the pet food report also examined upcycled ingredients, which are those nutritious ingredients that humans do not typically consume, such as organs and bones, or byproducts from the human food industry. The findings highlight pet food’s sustainability contributions, with more than 3 million tons of upcycled ingredients used in dog food and over 1 million tons in cat food in 2024.

Turning research into actionable tools

IFEEDER developed these reports to serve as tools the animal food industry can use to tell a more complete story about feed and pet food’s vital role in agriculture and the economy. With analytical support from Decision Innovation Solutions and IFEEDER’s project partners and funders, this research equips companies with credible, up-to-date information to share with stakeholders, customers and policymakers.

To support industry use, IFEEDER offers a suite of resources to accompany both reports, including downloadable infographics, multimedia maps and data aggregated by state, species and ingredients. Explore the full reports and resources at ifeeder.org.