The strength of demand for U.S. grains from trade agreement partners in the 2019/2020 marketing year again showed the importance of market access through strong trade policy — and negotiation of new trade agreements in areas likely to grow substantially in the coming decades.

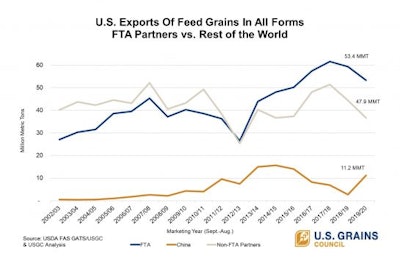

Free trade agreement (FTA) partners purchased more than half of all U.S. exports of grains in all forms (GIAF) in the last marketing year, according to data from the U.S. Department of Agriculture (USDA) and a U.S. Grains Council (USGC) analysis.

The United States has 14 official FTAs in place with 20 countries. These trading partners represent some of the largest and most loyal customers for U.S. GIAF exports, a holistic measure of the feed grains and related commodities produced by U.S. farmers and consumed by overseas customers.

To calculate GIAF, USGC reviews exports across 10 product sectors, including raw grain exports of U.S. corn, barley and sorghum and value-added products including ethanol, distiller’s dried grains with solubles (DDGS) and other co-products as well as the corn equivalent of exported meat products.

For the 2019/2020 marketing year (September 2019-August 2020), U.S. FTA partners imported 53% of all U.S. GIAF exports at 53.4 million metric tons, equivalent to 2.10 billion bushels.

Breaking down these agreements, the United States-Mexico-Canada Agreement (USMCA) ranks as the top FTA for grain-related trade. Geographic proximity, duty-free access provided by the North American Free Trade Agreement (NAFTA) and decades of market development work have established both Mexico and Canada as large and growing markets for U.S. GIAF.

Mexico claimed the top spot for imports of U.S. GIAF in the 2019/2020 marketing year at 23.7 million metric tons (equivalent to 936.2 million bushels), valued at $6.65 billion. By commodity, Mexico was the top international buyer of U.S. corn, DDGS and barley/barley products, the second-largest global destination for U.S. sorghum and the seventh-biggest market for exports of U.S. ethanol.

U.S. GIAF exports to Canada were the third-highest on record in 2019/2020, despite declining 12.3% from last year’s all-time high. Overall, Canada was the fourth-largest buyer of U.S. GIAF in the marketing year, with imports of 7.07 million metric tons (equivalent to 278 million bushels), valued at $3.08 billion. By commodity, Canada ranked as the largest buyer of U.S. ethanol, the second-largest buyer of U.S. barley/barley products and the sixth-largest buyer of U.S. corn eighth-largest buyer of U.S. DDGS.

The dataset used to generate this analysis does not include recent trade pacts that offer market access for U.S. coarse grains, co-products and ethanol but are not full free trade agreements, including those with Japan and China. Yet, the sales to these trading partners further demonstrate the importance of policy actions that maintain and grow U.S. market share.

The U.S.-Japan trade agreement, for example, went into effect on Jan. 1, 2020. The agreement both preserved duty-free market access for U.S. feed and food corn, corn gluten feed and DDGS and eliminated tariffs or reduced mark-up on other coarse grains and co-products.

Japan ranked as the second-largest GIAF market in 2019/2020 with exports of 13.4 million metric tons (equivalent to 527.5 million bushels), valued at $5.47 billion. By commodity, Japan represented the second-largest buyer of U.S. corn, the third-largest buyer of U.S. barley/barley products, the fourth-largest buyer of U.S. sorghum and the seventh-largest buyer of U.S. DDGS.

The U.S.-China Phase One deal, signed in January 2020, allowed importers to obtain exclusions for corn and other agricultural products from retaliatory tariffs imposed on agricultural products in July 2018. The deal also included a long-awaited import protocol for U.S. barley and barley products and opened the door to a substantial jump in U.S. sorghum purchasing.

As a result, year-over-year exports to China quadrupled, making the market the third-largest destination for U.S. GIAF. Exports totaled 11.2 million metric tons (equivalent to 441 million bushels), valued at nearly $4 billion. By commodity, China ranked as the top global buyer of U.S. sorghum and fifth-largest international buyer of U.S. corn.

USGC is working to build on this momentum with partners in the USDA and the U.S. Trade Representative (USTR) to forge new trade agreements with countries and regions that offer new growth opportunities for grains and grain products. Key targets include countries in Southeast Asia that have seen a marked increase in sales of DDGS and other corn co-products; India, which shows possibilities for U.S. ethanol and DDGS; and Kenya, which could provide a platform to achieve further market access in other African countries.

In addition to new trade agreements, the daily, on-the-groundwork of promoting U.S. agricultural products, fighting non-tariff trade barriers and building global demand is critical to making trade work and keeping U.S. farmers competitive.

With a full-time presence in 28 locations, USGC’s global network operates programs in more than 50 countries and the European Union on behalf of U.S. farmers and agribusiness members. Building these long-lasting relationships has allowed USGC to capitalize on market opportunities and support the trade of U.S. corn, barley, sorghum, ethanol, DDGS and other co-products for more than six decades, remaining laser-focused on meeting the world’s feed and fuel needs. ■

About the Author

Floyd D. Gaibler serves as the director of trade policy for the U.S. Grains Council. In his role, Gaibler works with government officials and the White House to address policy issues related to the export of U.S. feed grains and their co-products.