International trade involves a complex set of regulations established through the World Trade Organization (WTO) and other international rules-based institutions to which each trading partner has agreed to adhere.

These legal structures can help provide duty-free access or protection from a harmful pest, but they can also be used inappropriately to inhibit trade –- becoming what are known as non-tariff trade barriers.

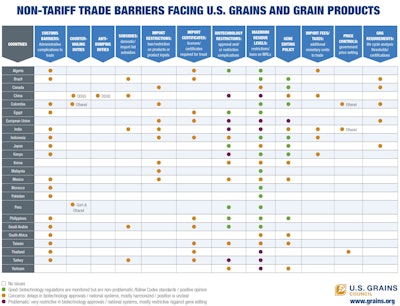

To help educate grains value chain members, the U.S. Grains Council (USGC) has cataloged the non-tariff trade barriers facing U.S. coarse grains and grain products in a new visual resource, now available at grains.org.

“Non-tariff barriers can be wide-reaching and complex, and it is important to understand the specific nuances behind each individual measure,” said Floyd Gaibler, USGC director of trade policy and biotechnology.

“USGC uses information about non-tariff barriers to engage with importing countries to determine how best to encourage mutual growth through open trade while respecting the goals of our trading partners.”

There is a clear difference between non-tariff barriers and tariff barriers. Tariff barriers are taxes set on imports or exports, with rates often governed by the WTO or free trade agreements. Non-tariff barriers, on the other hand, are not always bound or regulated by an independent international body.

These trade-limiting measures come in many forms and can be hard to quantify. For example, some importing countries have restrictive biotechnology policies or overly restrictive residue levels on crop protection products. These measures effectively block crops produced through biotechnology or using these products from being sold into the market.

Countries also institute non-tariff barriers through administrative requirements, such as customs barriers, licensing requirements or unspecified time frames on resolving disputes. Other times these barriers are more formal, such as import restrictions or bans on certain products or duties stemming from countervailing duties or anti-dumping investigations into specific commodities.

Importing countries can also set economic restrictions – such as import fees, taxes and price controls – to make imported products uncompetitive against domestic equivalents.

USGC works to remove non-tariff barriers with international dispute mechanisms like those structured into the WTO or Codex Alimentarius. USGC also works directly with the U.S. government and local regulators, policymakers and other stakeholders to present the benefits of removing the barriers and engaging in freer and fairer trade.

“All of these challenges require continuous work to identify and mitigate in a comprehensive effort to keep U.S. grains and grain products flowing around the world,” Gaibler said. “While low or zero tariffs are always advantageous, addressing non-tariff measures is equally important to our ongoing market access.”