American producers have been hit hard in the past few years by hurricanes, floods, tornadoes, typhoons, volcanic activity, snowstorms and wildfires. Farmers and ranchers in the South are still recovering from Hurricanes Michael and Florence, while producers in the Midwest are reeling from unprecedented flooding this spring. Several Market Intel articles have reviewed recent disasters as well as the historical delays in planting this year, Farmers Need Disaster Assistance and Crop Planting Delays Reach Historic Levels Resulting in High Levels of Uncertainty for 2019.

On June 3, the House passed a $19.1 billion disaster aid bill, H.R. 2157, that previously passed the Senate with overwhelming support. Now awaiting a presidential signature, this package includes more than $5.2 billion to assist USDA and related programs. The bill also includes funding for nutrition programs in Puerto Rico, American Samoa and the Northern Mariana Islands. This Market Intel highlights the agriculture-related provisions in the disaster aid package.

Farm Disaster Assistance

USDA was allotted $3.005 billion to assist with the loss of crops because of Hurricanes Michael and Florence, as well as other natural disasters occurring in the 2018 and 2019 calendar years. These crops and commodities include milk, on-farm stored commodities, crops prevented from planting in 2019, trees, bushes, vines and harvested adulterated wine grapes. Funding will be available until Dec. 31, 2020. A provision is also included for losses due to Tropical Storm Cindy, as well as losses of peach and blueberry crops from extreme cold and hurricane damage in 2017 and 2018. Orchardists and pecan tree growers may receive payments if their tree mortality rate is over 7.5% and below 15% (adjusted for normal mortality) in calendar year 2018.

Importantly, payments for crop insurance policies under the Federal Crop Insurance Act or the Noninsured Crop Disaster Assistance Program will cover up to 90% of the loss. Crops not covered under these programs can receive up to 70% of the loss. If a crop is offered a revenue insurance policy under the Federal Crop Insurance Corporation, the greater of the projected price or harvest price for that crop will be used to determine the expected value. (Note: There is widespread confusion among growers as to how this provision may relate to crops prevented from being planted, i.e., if prevent planting payments are made on 70% to 90% of the revenue guarantee it could influence planting decisions given the historic delays experienced in both corn and soybean plantings.)

If producers receive these payments, they are required to purchase crop insurance where it is available (under NAP if crop insurance coverage is not available) for the next two available crop years.

Finally, up to $7 million is provided for Whole Farm Revenue Protection indemnity payments that were reduced in 2018. This program provides a safety net for all commodities on a farm under one insurance policy.

Farm Service Agency Emergency Programs

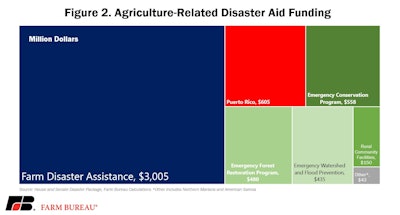

To help owners of non-industrial private forests restore forest health, the Emergency Forest Restoration Program was allotted $480 million. In addition, the measure allocates $558 million for the Emergency Conservation Program, which helps farmers and ranchers recover damaged farmland and install methods for water conservation during a severe drought, and $435 million for Watershed Protection and Flood Prevention Practices to assist with rural watershed recovery.

Rural Development

The bill provides $150 million for Rural Development Community Facilities grants. These grants assist small rural communities in improving and repairing essential public services and facilities. However, these payments will not be applicable if the community is already receiving assistance from the Rural Community Advancement Program via the Rural Development Trust Fund, grants and guaranteed loans.

Market Facilitation Program AGI Waiver

As of May 13, the first round of trade aid provided $8.5 billion in market facilitation program payments to farmers and ranchers, Figure 1. One limiting factor, however, was that trade assistance was capped at $125,000 per operator and farmers with an adjusted gross income above $900,000 were not eligible for trade assistance.

The disaster relief bill amends this provision and waives the eligibility requirement with respect to adjusted gross income. A person or legal entity is now eligible to receive payments under the Market Facilitation Program if the average adjusted gross income exceeds $900,000 and more than 75% of the adjusted gross income comes from farming, ranching or forestry-related activities. Payment remains capped at $125,000 per operator.

Nutrition Assistance

The disaster bill includes provisions for disaster nutrition assistance in the Commonwealth of the Northern Mariana Islands, Puerto Rico and American Samoa. Assistance totals $643.2 million to these U.S. territories in response to major disasters or emergencies designated by the President.

Hemp Crop Insurance

The disaster aid package also included language offering coverage for hemp under the whole farm revenue protection insurance policy starting in the 2020 reinsurance year. The 2018 Farm Bill Provides A Path Forward for Industrial Hemp, but there was uncertainty about when hemp would be eligible for federal crop insurance.

Summary

The recently passed disaster relief bill provides emergency assistance to farmers dealing with the aftermath of natural disasters, as well as farmers impacted by late planting. Most of the agriculture-related funding — slightly more than $3 billion — is for farm disaster assistance related to hurricanes, floods, tornadoes, typhoons, volcanic activity, snowstorms and wildfires. Other funding is allocated for nutrition, conservation, forestry and watershed assistance programs. Figure 2 details the agriculture-related disaster spending by program.

Contact:

Allison Wilton, Economic Analysis Intern

American Farm Bureau Federation

Phone: (202) 406-3758

Email: [email protected]

John Newton, Ph.D., Chief Economist

American Farm Bureau Federation

Phone: (202) 406-3729

Email: [email protected]