Just 14 days after enrollment opened for the Paycheck Protection Program, the $349 billion appropriated for the program was depleted. The speed at which funding was exhausted astounded even those administering the program. A prime example, on April 3, when the application window opened for all small businesses except independent contractors and self-employed individuals, Treasury Secretary Mnuchin predicted the funds would last through June 6.

The quick depletion had little impact on farmers and ranchers, who, according to SBA statistics, made very limited use of the program. There are several reasons for this, which need to be addressed if and when Congress appropriates additional funding for this program.

The Small Business Administration was given a large task when the CARES Act was passed on March 27. Administering a new program in such short order was undoubtedly challenging. The extremely quick seven days between the passage of the bill and the first application window made it unlikely that every possible question could be answered. This meant that businesses and lenders with previous SBA experience were better positioned to take advantage of PPP as it became available. Before the PPP, most farmers and ranchers had never worked with SBA. Those in agriculture were most often referred to USDA’s Farm Service Agency. The result is that farmers and ranchers and the SBA knew very little about each other.

Those who work within, for and around agriculture know that farms, ranches and horticultural businesses are unique. Agricultural enterprises, as they’re referred to by SBA, are different from other small businesses in many ways, including but not limited to utilization of different tax forms; a labor force that is supported by seasonal employees, including foreign workers in the U.S. on visas; utilization of labor contractors rather than directly hired employees; and rent that is not limited simply to a single structure, but often includes land, equipment, multiple structures, etc.

This is just a small list of farms’ and ranches’ many distinct business characteristics that immediately prompted questions when the PPP was launched. SBA and USDA have diligently tried to answer questions, but the slow trickle of information made it difficult for agriculturalists to apply.

Another important element that likely led to farmers’ and ranchers’ low signup was the slow release of guidance for the self-employed and independent contractors. SBA began accepting applications for these small businesses on April 10, but guidance related to these applications wasn’t released until April 14, less than 48 hours before funding ran out.

In 2019 an average of 15.7 million Americans was self-employed, according to the Bureau of Labor Statistics. That’s equivalent to 10% of the U.S. workforce. However, when you also account for the employees of the self-employed, the share of the U.S. workforce rises to approximately 30%, according to research by the PEW Institute. This is not an issue that exclusively impacts agriculture, though agriculture is among the list of industries with the highest rate of independently employed people.

In addition to unanswered questions that have arisen from the program itself, access to approved lending institutions has also been a struggle. Initially, SBA-approved lenders were overwhelmed by applications, leading them to prioritize completing loans with existing business customers. It is hard to blame banks for doing so, but it left new customers without a lender.

SBA aggressively tried to enroll new lending institutions into the program, though it is our understanding that the process was still slow and frustrating. Further, when PPP appropriations were exhausted, SBA announced that it would stop approving new lenders until additional funds were received. This means that if and when new funds are available, community banks and Farm Credit institutions that rural communities depend on that did not get approved during the first window will once again be at a disadvantage for this first-come, first-served program.

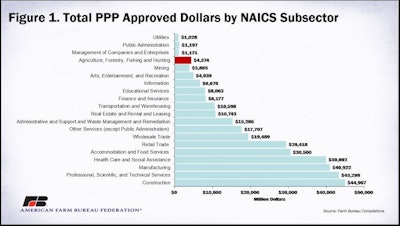

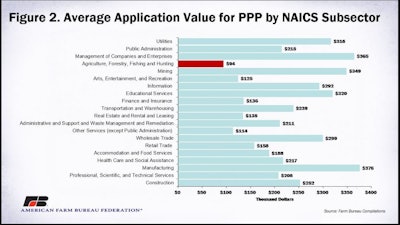

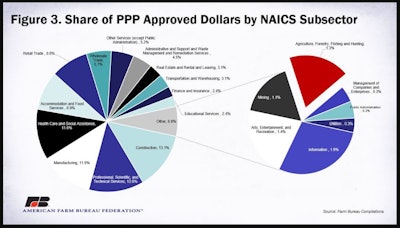

This is not meant to be an exhaustive list of the problems the agriculture sector has faced when applying for the PPP. However, it does help illuminate why through April 16, of the 1,661,367 approved loans, 46,334 of them were to the agriculture, forestry, fishing and hunting sector. This represented only 1.3% of the total approved funding and 2.8% of approved applications. The PPP had approved $4.374 billion to the agriculture, forestry, fishing and hunting sector with an average application approval of $94,409. Of the 20 subsectors SBA reported on, the agriculture, forestry, fishing and hunting sector had the lowest average loan approval.

Conclusion

Congress has been debating additional funds for the PPP since last week, though no resolution has been reached at this time. In order for additional funds to be helpful for agriculture, however, many outstanding questions need to be answered.

Conact:

Veronica Nigh, Economist

(202) 406-3622