Agricultural products have much supported the panamax segment thus far, offering a significant cargo injection in an otherwise subdued dry bulk environment.

Grains demand rose from March onwards as countries began stockpiling and China’s swine herd has been steadily growing.

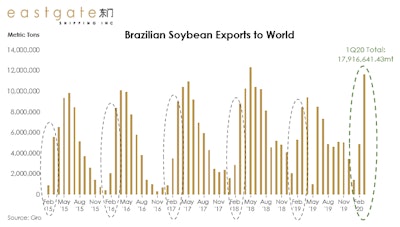

Further to that, China’s soy inventories reached record lows forcing over half of its crushers to suspend operations earlier in the year, while awaiting inbound cargoes to arrive. 75% (or 13.3 million tonnes) of the Brazilian exports during the first quarter of 2020 headed to China.

The large Brazilian harvest this season along with the significant depreciation of the local currency against the U.S. dollar (the Brazilian real lost almost a third of its value since January), automatically made Brazilian beans cheaper -– which is reason enough to trigger more buying from Chinese crushers.

Usually, this time every year we are in anticipation of an increase in fronthaul shipments as seasonally South American grain exports peak in Q2.

First half of April has indeed seen Brazilian bean exports spike – up by 50% m-o-m – and it remains to be seen how the coming weeks will unfold.

With reference to Chinese purchases of US agricultural products under the Phase One trade deal, Beijing is seen reassuring of living up to its commitments.

The lower US soy exports can be attributed to seasonal reasons (as U.S. grain exports tend to peak during the last quarters each year) as well as their price disadvantage.