Bumper crops are great but they sure can wear you out,” Mike said to no one in particular as he walked to his pick-up truck. Sliding into his seat he glanced at the train his guys were loading and smiled, “At least trains are turning better this year. We’ll get through this yet.”

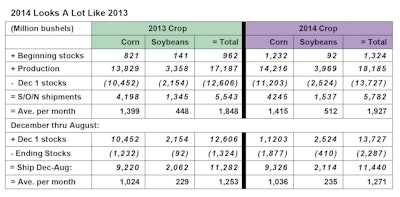

USDA’s Dec. 1, 2014 Quarterly Stocks report showed 1.1 billion (B) more bushels of corn and soybeans on hand than in 2013, and Mike has been concerned how elevators will be able to ship everything. (Wheat stocks are also higher, but not significantly.) He thought back to the 13.8B bushel corn crop in 2013 and the challenges of last year, including wild swings in rail freight, winter weather that slowed shipments, and a soybean market that was inverted almost all year. Last year, he recalled, he and his merchandiser, Jeff, met regularly to update logistics and merchandising plans, and those efforts paid off. Can they do as well this year?

Mike sat down after the Jan. 12 crop reports and looked at the numbers more closely. What he found surprised him: Corn stocks on Dec. 1, 2014 were 750 million (M) bushels higher than in 2013, but just three states accounted for 600M of the increase: Iowa, Illinois, and Missouri. A few states showed minor increases but quite a few showed slightly lower corn stocks! U.S. soybean stocks were up 370M bushels, but that increase was scattered: Iowa soybean stocks were up 70M bushels, with most other states showing increases of as little as 5 to 20M bushels.

After Mike looked at the reports, he figured out that things are more manageable than he first thought: His state’s corn plus soybean inventories are only slightly larger this year, and the projected ending stocks in 2015 are higher. The end result is his state actually has to move fewer bushels between December and August than a year ago! “It’ll still be a challenge but we’ll make it work,” thought Mike. Overall the U.S. may only need to ship 160M more bushels from December through August than a year ago (11.44B vs. 11.28B bushels).

Mike knows one key to successful logistics planning is to use the right data. U.S. and state statistics are useful and interesting: A record corn crop, for example, will affect price, basis and spreads. But Mike needs to plan based on his local numbers. He started with his current inventories, and then he estimated how many bushels the elevator might receive this spring and summer from on-farm storage. Next he projected what his Sept. 1 ending stocks might be, which tells him approximately how much he will have to ship between now and the end of summer.

His calculations show that just as with 2013 crop, he’ll need to ship nearly at capacity every month. He doesn’t have the luxury of waiting a few months trying to hit the high of the basis before he and Jeff liquidate everything. Futures spreads will also be important to his spring and summer merchandising. Every cent Mike earns from a futures carry offsets 1¢ of the interest cost on those bushels he has to hold into summer due to shipping limitations. He recalls how quickly some of the good soybean carries vanished last fall and vows not to be complacent again. The March/May futures spread in corn at 8¢ or above will pay for almost five months of interest at 5%, for example. Mike had Jeff set that carry at 8½¢ on about one-half of the bushels the elevator will probably own past March 1 and they have orders working for the balance.

Jeff already liquidated much of the elevator’s company-owned soybean inventory in December when basis was red-hot while the U.S. export program was at its peak. Now most of the elevator’s soybean inventory is farmer-owned. Jeff will sell those soybeans when they accumulate quantities as farmers sell or even go short the basis in small lots if buyers get aggressive.

Risk squared

Mike feels good about his merchandising and logistics plans, but he is worried about other risks these days. The global marketplace seems smaller than ever before. Recently the Swiss National Bank suddenly removed the three-year cap on how high the Swiss franc could trade relative to the euro. In 30 minutes the Swiss franc soared 25+%. A lot of forex speculators lost huge amounts, several forex brokerage firms failed when customers couldn’t meet the margin calls, and other firms had to find additional capital. The U.S. dollar has soared to 11-year highs as the U.S. suddenly seems the safest among world currencies. And all else equal, a strong dollar tends to weigh on U.S. exports and on commodity prices. Crude oil has fallen 55% in six months, slicing the profitability of the U.S. ethanol sector.

Then there are biotech issues. China shut off imports of U.S. corn and DDGs last fall, but now has reopened that market tentatively. Countries have shut off imports of U.S. beef or other meats for real or perceived health concerns.

In a global market little is really unrelated. Managed funds that lose big in currencies or crude oil may be forced to liquidate soybeans or corn to free up funds. Or funds that become disillusioned with energy could suddenly pour money into ag markets. The next Black Swan that strikes could hit grains or soybeans directly.

New regulations arising from the Dodd-Frank legislation are also changing the very structure of the brokerage sector. Futures firms must collect on margin calls faster than ever in order to ensure they have sufficient funds on hand to meet tougher capital requirements. Now even the very definition of “what is a hedge” is under scrutiny in a pending CFTC rulemaking.

There could be more rough waters ahead in 2015, however, so strap on your life jacket.

- Stay fully hedged; trying to outguess these markets is high-risk.Be ready to set futures carries when they approach 80% of full carry.

- Eliminate freight cost-risk wherever and whenever possible. Consider locking in truck fuel costs.

- Review hedging credit lines to be sure they are sufficient to cover even any unlikely futures move.

- Monitor basis risk closely. What would happen if your main market was suddenly no longer available?

Fortunately, the US has seen two successive record corn and soybean crops, and volume goes a long ways toward a profitable year. ❚

Hypothetical performance results have certain inherent limitations, and do not represent actual trading. Past results are not indicative of future outcomes. Trading futures involves risk of loss.

Diana Klemme is a longtime contributor to Feed & Grain. Contact her at Grain Service Corporation, Atlanta, GA, by calling 800-845-7103 or email at [email protected].