Biofuel Groups Challenge EPA’s Small Refinery Waivers

On Wednesday, Oct. 23, multiple biofuels groups filed a petition in the U.S. Court of Appeals against the Environmental Protection Agency (EPA), challenging the agency's process for granting refineries exemptions to the nation's biofuel blending mandates.

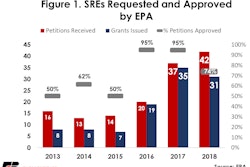

The group’s are challenging the EPA's process for granting waivers to 31 oil refineries.

The petition was filed by groups including: Renewable Fuels Association and American Coalition for Ethanol and Growth Energy.

The biofuels industry has criticized the Trump administration for expanding the number of waivers granted claiming the exemptions undercut demand for fuels such as ethanol and biodiesel.

Last week the EPA proposed a plan for the 2020 and 2021 crop years that has the ability to lower U.S. renewable fuels output.

FBN’s Take On What It Means: We believe that the EPA’s small refinery exemption (SRE) proposal has the ability to reduce ethanol and biodiesel production which can reduce corn and soybean demand and suppress local basis. At FBN we’re unsure how challenging the waivers in courts before the EPA makes their final decision on the RFS can impact the U.S. farmer. We will continue to monitor this situation for future developments.

China to Increase Imports Including Farm Products

According to Reuters, Chinese state television reported that China will start to increase imports of certain goods including agricultural, consumer and components products as part of its efforts to stabilize foreign trade.

Reuters reported that the Chinese State Council is working to improve policies on tax rebates, trade finance, and ease restrictions for capital account transactions.

China will take steps to support trade and foreign investment.

Reuters also stated that stabilizing trade and foreign investment is part of Beijing's policies to support the slowing economy.

FBN’s Take On What It Means: Another encouraging signal from the Chinese government about working to restore the country’s massive trade imbalance but as always at FBN we want to see details. We continue to believe that any policy that increases U.S. agricultural imports can be a positive for the U.S. farmer.

The risk of trading futures, hedging, and speculating can be substantial. FBN BR LLC (NFA ID: 0508695)