Though Chapter 12 family farm bankruptcies during the first half of 2020 slowed to 284 filings, down 10 filings from the first half of 2019, at 580 filings, family farm bankruptcies are 8% above year-ago levels, according to recently released data from the U.S. Courts. In addition, bankruptcies during the second quarter of 2020 were down to 115 filings, nearly 50 fewer filings than the second quarter of 2019.

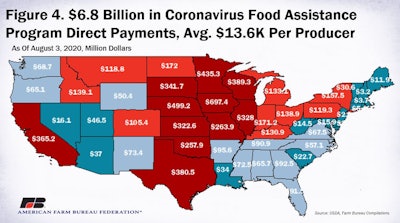

The lower number of filings at a time when farmers and ranchers are struggling with the impact of COVID-19 is due in large part to the financial assistance provided by the Coronavirus Aid, Relief, and Economic Security Act, including direct payments to agricultural producers through the Coronavirus Food Assistance Program, the availability of Paycheck Protection Program loans, temporary payment deferrals and forbearance consideration for borrowers. The fact that the bankruptcy process is now virtual also probably contributed to the decline.

Importantly, many of the CARES Act protections are expiring, and without additional support for agricultural producers, e.g., What’s in the HEALS Act for Agriculture? and The HEALS Act and PPP, a surge of bankruptcy filings is expected as low commodity prices and farm income make it tough for farmers to hang on. Rising farm loan delinquency rates also point toward the increased likelihood of filings.

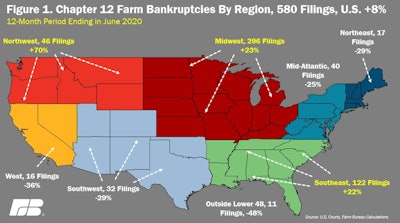

Chapter 12 Bankruptcies by Region

Bankruptcy rates over the previous 12 months were the highest in the Midwest, Northwest and Southeast. Farmers in these regions filed a combined 464 bankruptcies, representing 80% of the filings across the U.S. At nearly 300 filings, a 23% increase, more than 50% of the Chapter 12 filings were in the 13-state Midwest region. The Southeast had 122 Chapter 12 filings, an increase of 22% over prior-year levels. Figure 1 highlights Chapter 12 bankruptcy filings by region and the year-over-year change.

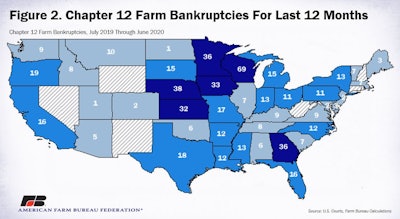

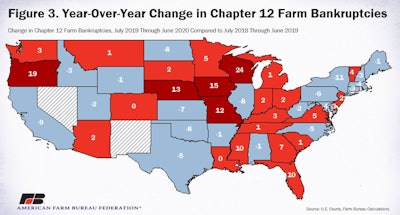

During the previous 12 months, Chapter 12 farm bankruptcies were the highest in Wisconsin at 69 filings. Following Wisconsin, Nebraska had 38 Chapter 12 filings and Georgia and Minnesota each had 36 filings. Chapter 12 farm bankruptcies rose in many states across the Midwest, West and Southeast. Wisconsin had the largest increase — 24 more filings than the prior 12-month period. Following Wisconsin were Oregon and Iowa, with 19 and 15 additional Chapter 12 bankruptcy filings, respectively. Figures 2 and 3 highlight Chapter 12 bankruptcy filings and the year-over-year changes.

How Successful Are Chapter 12 Bankruptcies?

In 2017 Congress added Section 1232 to Chapter 12, which allows farmers to de-prioritize capital gains taxes resulting from the sale of assets used in farming (including land). Farmers can treat that tax debt as ordinary debt, which in some cases may be discharged at the end of the case. This and the many other features of Chapter 12 can make it one of the most powerful reorganization tools in the Bankruptcy Code. As one might expect, those advantages often result in Chapter 12 having the highest percentage of successfully completed cases of the reorganization chapters (typically Chapters 11, 12 and 13).

The Association of Chapter 12 Trustees recently asked their members to examine the number of plans filed and confirmed by the bankruptcy court from 2011 through 2013. Because plans often last as long as five years, and may take longer than that to fully close, those three years represent the three most recent years for which all cases should be completed. Although only 18 members responded, those responses covered approximately 15% of the total Chapter 12 cases filed in the country for those years.

The results of the survey showed that for 2011, 53.5% of the confirmed plans were completed. In 2012, the percentage was 62.2%. For the cases filed in 2013, 63.9% of them successfully completed their plans. The average completion rate for those years equals 59.4%.

Another less formal survey by the Association of Chapter 12 Trustees in 2019 bore out those results. In that survey 33 trustees were asked to estimate the average success rate for their cases with confirmed plans. Those responses ranged from 25% up to 90%. The average of those responses was 59.6%, very close to the average of this year’s survey.

Assuming average completion rates in Chapter 12 reorganizations are in the 60% range, how does that compare with other reorganization chapters of the Bankruptcy Code? Generally, Chapter 11 plans (the other business reorganization chapter) are regarded as having a completion rate of 15% or less, while the national average for Chapter 13 cases is typically below 60%.

While not all Chapter 12 cases reach a completed plan, it does appear that on average, more than half do. It is important, however, not to confuse completion of a plan with success. In some cases, a Chapter 12 reorganization allows farmers and their creditors to negotiate a mutually acceptable outcome, which may result in a dismissal of the case or a conversion to Chapter 7. There really are no readily available statistics that track these outcomes, but when factored into the conclusion that over half of the plans do reach completion, it appears that most farmers and fishermen with confirmed plans do reach a successful outcome.

Summary

As a result of the stimulus provided in the CARES Act, and to some extent the likely difficulties associated with filing a Chapter 12 case virtually, Chapter 12 farm bankruptcies slowed in the second quarter to 115 filings, down nearly 50 filings from the previous year. During the 12-month period ending in June 2020, Chapter 12 filings totaled 580 cases, up 8% compared to year-ago levels. This slowdown in farm bankruptcies is likely temporary given that many of the CARES Act protections are expiring.

Many sectors of the farm economy continue to be impacted by COVID-19, and many eligible producers have yet to receive the financial support provided by the CARES Act. As of August 3, $6.8 billion in Coronavirus Food Assistance Program payments have been delivered to producers, approximately 43% of the estimated $15 billion in first tranche payments.

Moreover, many agricultural producers remain ineligible for CFAP, e.g., aquaculture, floriculture and horticultural products, or do not have funds appropriated for relief, e.g., contract poultry producers. Without additional support for agricultural producers, we can expect an acceleration of farm bankruptcies in the immediate future.

Congress is poised to address these challenges in the farm economy through some combination of the Senate’s proposed HEALS Act and the House-passed HEROES Act. Both bills would provide financial support to producers and processors of agricultural products and would boost the farm economy by offsetting low commodity prices and farm income.

Contacts

John Newton, Ph.D., Chief Economist, American Farm Bureau Federation

[email protected]

Jan Sesenich, President, National Association of Chapter 12 Trustees