The USDA expects farmers to harvest 13.8 billion bushels of corn this fall with a national average yield of 168.4 bushels/acre.

The production estimate came in slightly higher than expected, while yield was only increased by 0.2 bpa.

Soybean production was forecast at 3.55 bb, within the range of pre-report estimates, while the national average yield was 46.9 bpa, also within expectations.

Soybean ending stocks, however, dropped to 460 million bushels (mb), a 180 mb decline that’s within the range of pre-report estimates.

WHEAT: The outlook for 2019/20 U.S. wheat this month is for smaller supplies, reduced total use, and rising ending stocks. Wheat production is cut 18.5 million bushels to 1,962 million based on the NASS Small Grains Summary, issued on September 30. Projected imports are lowered 15 million bushels to 120 million on a slow pace to date. The NASS Grain Stocks report raised 2018/19 ending stocks 8 million bushels and estimated first quarter 2019/20 stocks at 2,385 million bushels, down fractionally from the previous year.

These stocks imply first quarter feed and residual use is similar to last year. Annual 2019/20 feed and residual use is lowered 30 million bushels to 140 million but remain above last year’s revised 89.8 million. Wheat exports are lowered 25 million bushels to 950 million on reduced competitiveness in international markets. Ending stocks are projected at 1,043 million bushels, up 29 million from the previous month, and the season-average farm price is lowered $0.10 per bushel to $4.70. Global 2019/20 wheat supplies are raised fractionally with decreased production offset by higher beginning stocks. World production is lowered 0.3 million tons led by a 1.0-million-ton cut to Australia’s crop on further drought effects.

The United States is lowered 0.5 million tons, and Canada and Serbia are each reduced 0.3 million tons. Partly offsetting are production increases of 1.0 million tons for the EU and 0.7 million tons for Turkmenistan, both on updated harvest reports. Projected global exports for 2019/20 are lowered 1.2 million tons led by a 1.0-million-ton reduction for Australia reflecting their smaller crop. Total imports are decreased 1.1 million tons with the United States, Turkmenistan, Venezuela, and Kyrgyzstan accounting for most of the decline.

World wheat consumption is reduced 1.1 million tons primarily on a 0.8-million-ton reduction in U.S. feed and residual use. With supplies rising and use declining, global ending stocks are raised 1.3 million tons to a record 287.8 million.

COARSE GRAINS: This month’s 2019/20 U.S. corn outlook is for slightly lower production, reduced exports and corn used for ethanol, greater feed and residual use, and lower ending stocks. Corn production is forecast at 13.779 billion bushels, down 20 million as a decline in harvested area more than offsets an increased yield forecast. Corn supplies are forecast down sharply from last month on a reduced crop and lower beginning stocks based on the September 30 Grain Stocks report.

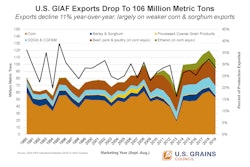

Exports are reduced 150 million bushels reflecting smaller supplies and U.S. price competitiveness. Corn used for ethanol is down 50 million bushels based on weekly production data as reported by the Energy Information Administration during September. Projected feed and residual use is up 125 million bushels based on indicated disappearance during 2018/19. Corn ending stocks for 2019/20 are lowered 261 million bushels. The season-average corn price received by producers is raised 20 cents to $3.80 per bushel. WASDE-593-2 Grain sorghum production is forecast lower from last month, with a 0.4-bushel-per-acre decline in yield to 73.9 bushels per acre and a reduction in harvested area.

Barley and oat production estimates are updated based on the September 30 Small Grains report. Global coarse grain production for 2019/20 is forecast virtually unchanged at 1,396.7 million tons. The 2019/20 foreign coarse grain outlook is for higher production, increased trade, and higher stocks relative to last month. Foreign corn production is forecast modestly lower as an increase for Russia is more than offset by declines for Egypt and Syria. The projected corn yield for Russia is raised based on reported harvest results to date.

Corn exports are raised for Russia, with a more than offsetting decline for the United States. For 2018/19, corn exports for Brazil are raised for the local marketing year beginning March 2019 based on record large shipments during the month of September.

From July to September Brazil has exported close to 20 million tons of corn, nearly 50 percent above the previous high for the time period, with large shipments to important U.S. markets such as Japan, South Korea, Mexico, and Colombia.

For 2019/20, corn imports are lowered for Saudi Arabia, Mexico, Venezuela, Cuba, and Bangladesh. Foreign corn ending stocks are higher, mostly reflecting increases for Brazil, Canada, and the EU. Global corn stocks, at 302.6 million, are down 3.7 million from last month.

OILSEEDS: U.S. oilseed production for 2019/20 is projected at 107.9 million tons, down 2.3 million from last month with lower soybean, peanut, and cottonseed production partly offset by higher canola and sunflowerseed. Soybean production is forecast at 3.6 billion bushels, down 83 million, mainly on lower yields. The soybean yield is projected at 46.9 bushels per acre, down 1 bushel from the September forecast. Harvested area is reduced slightly to 75.6 million acres.

Soybean supplies for 2019/20 are forecast at 4.5 billion bushels down 175 million on lower production and beginning stocks. With a small increase in soybean crush, ending stocks are projected at 460 million bushels, down 180 million. WASDE-593-3 The U.S. season-average soybean price for 2019/20 is forecast at $9.00 per bushel, up 50 cents reflecting smaller supplies. The soybean meal price is forecast at $325.00 per short ton, up $20.00. The soybean oil price forecast is raised 0.5 cents to 30.0 cents per pound.

Global oilseed production for 2019/20 is projected at 574.8 million tons, down 4.6 million from last month on lower soybean, sunflowerseed, rapeseed, and peanut production. Global soybean production is projected at 339.0 million tons, down 2.4 million to a 4-year low, mainly reflecting lower production for the United States. Global rapeseed production is forecast lower on reductions for Canada, Australia, the EU, and the United States.

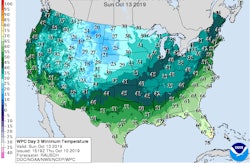

Canadian rapeseed production is reduced on lower yield prospects resulting from an unseasonably heavy snow and a season-ending freeze. Other production changes include lower sunflowerseed production for Ukraine, lower cottonseed production for Pakistan and Brazil, and higher cottonseed production for India.

With lower global oilseed supplies only partly offset by reduced crush, global oilseed stocks are projected at 109.8 million tons, down 4.6 million.

Soybeans account for most of the change with lower stocks in the United States only partly offset by increases for Argentina and Brazil.

To read the full report, click here.