The availability of grain is a factor in determining the demand for grain transportation, says the latest USDA Grain Transportation Report.

Using 2019 harvest progress data, this feature examines the relationship between harvest progress and demand for transportation by barge.

It shows the current harvest progress is influencing barge transportation.

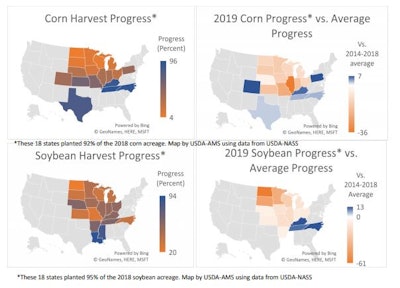

Pace of the Corn and Soybean Harvests Across the United States

Currently the percentage of harvesting completed is low in general but varies among states, largely depending on how favorable the year’s weather was for planting and growing crops in different parts of the country.

According to USDA’s National Agricultural Statistics Service (NASS), as of October 21, 30 percent of corn and 46 percent of soybeans has been harvested, versus 47 percent and 64 percent, respectively, for the previous 5-year average.

This shortfall from the average is partly due to delayed planting from poor weather in the spring, which also caused crop maturity to lag. For example, Illinois and Missouri are 34 percentage points and 22 percentage points, respectively, behind their prior 5-year-average corn harvest progress.

Similarly, North Dakota, South Dakota, and Minnesota are 61 points, 43 points, and 39 points, respectively, behind their normal soybean harvest progress.

Even where crops have matured, autumn rain in the Midwest has further delayed harvesting. States that have had drier weather, such as North Carolina, have made greater progress than those with wetter fall months.

Harvest Progress and Barge Transportation

Although poor weather and navigation conditions negatively affected overall barge traffic in 2019, the impact has varied by region.

The States where harvest has progressed at or above the normal pace (like Texas and North Carolina) either do not use the Mississippi River for barge shipments or (like Tennessee, Mississippi, and Louisiana) have access to the waterways below the locking system.

This situation has resulted in a larger share of barges arriving in the Gulf that have not transited the locks.

In 2019, 44 percent of the barges being unloaded in New Orleans from July 28 through October 19 did not come through the locks, compared to 40 percent in the same period in 2018.

The Ohio River and its tributaries run through States such as Pennsylvania, Tennessee, and Kentucky that have experienced rapid harvest progress. Because of that fast progress, the locking portion of the river system has experienced high volumes of grain traffic for the year and high recent soybean shipments.

At the Olmsted Lock and Dam near the Ohio’s confluence with the Mississippi, movements from July 28 through October 19 showed a 24-percent decrease in overall grain shipments from 2018 to 2019.

However, at the same location and for the same July-to-October timespan, movements showed nearly a 4-percent increase in soybean shipments from 2018 to 2019. Some States that access the Ohio River, such as Kentucky and Tennessee, are ahead of their average harvest rates while other States that also access the river are behind schedule.

Those that are behind — like Illinois, Ohio, and Indiana — produce significantly more grain, corn in particular. For the delayed states, the delays are greater for corn than for soybeans.

Because of slow harvest progress in the North and Midwest, the market for grain shipment by barge has r ecently been slow, reflected by low barge demand and low rates in the Twin Cities, mid-Mississippi River, and Illinois River.

In contrast, rates have recently been higher on the Ohio River and on the “Memphis-to-Cairo” stretch of the Mississippi, a more southern area where Tennessee and Kentucky have river access. However, it is important to note that even in these areas, this year’s rates have still generally fallen behind their 5-year averages.

If Northern States do not make adequate progress before the upper portions of the Mississippi close due to freezing, barge transportation will become unavailable, and grain purveyors who would normally ship grain by barge will be forced either to store until the river reopens or ship via a different mode.

A decision to store could create high demand for barge shipping in the spring months when the river has reopened.

Contact: [email protected]