Looking in the rearview mirror is dangerous when you’re driving down the road, but taking time to review how harvest unfolded can give us insight for the future. The August/September 2014 Merchandisers’ Corner, “An October Surprise?”, laid out issues and scenarios for harvest along with some expected outcomes. Setting down suggestions is easy, reviewing them afterward is tougher but equally important: to learn from the “hits” as well as the “misses.”

Chart 1 compares the August analysis (the green line) to last year and to the actual 2014 outcome: The blue line reflects current USDA production statistics by state. (The August article included volume and space across 23 states, covering 97% of corn production and 98% of US soybean production.)

In reality, the August state by state simulations turned out remarkably close to how harvest unfolded: Despite record production in corn and soybeans, there were only a handful of states where the total volume — relative to space — resulted in bigger space deficits than a year ago. And the story identified those states in August. Overall, corn and soybean production this year totaled 18.4 billion (B) bushels, just 1.1B bushels above last year’s 17.3B bushels. Farmers and commercials likely built more than 1.1B bushels of space in the past year, enough to absorb the increased production!

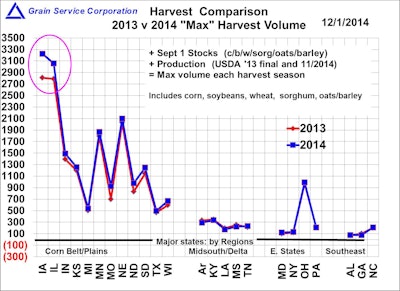

Chart 2 shows harvest statistics in a different way, with storage capacity omitted. This chart shows only each state’s total volume of bushels that had to find a home: Sept. 1 beginning stocks plus corn, soybean and sorghum harvest during Sept/Oct/Nov. Surprisingly only three states show significantly more volume this year compared to 2013: Iowa, Illinois and Missouri, with North Dakota a close fourth. Other factors accounted for whether a state showed higher volumes in 2014: Wheat production was off 100+ million bushels, and there was a significant shift in acres from corn to soybeans in many states. Nebraska’s corn acres were down 650K in 2014, with soybean acres up 600K, for example. But Nebraska’s corn yield rose 11 bushels/acre this year while soybeans rose just half a bushel/acre, resulting in total production that was nearly unchanged from 2013 in Nebraska.

“An October Surprise?” was about more than just bushels, considering farm marketing and basis implications, for example. The table (across) compares some of the highlights from “An October Surprise?” to what actually occurred during harvest.

Hits and misses

The August analysis hit the mark in a number of areas, including showing graphically where potential space shortages could be most severe this year. And the story hit the mark forecasting that farmers would favor storing over selling, and that basis would bottom early.

But the story missed the mark in a couple of important areas. One was not forecasting that barge freight would briefly soar to record levels in early October, or that performance would plummet on Eastern railroads as well as the Western lines. Freight costs and performance pushed interior basis in the Eastern and mid-South areas to nearly unheard of cheap levels this harvest. In turn, some elevators that had to ship during harvest were forced to sell cheaper values than had been available to them even weeks earlier for October.

A second “miss” was in not identifying the impact that poor railroad performance would inflict on end users: crushers unable to ship soymeal, and the inability to get corn trains to feedlots and poultry operations on schedule. Those shortfalls resulted in some end users having to “double-buy” at times to even maintain minimal feed inventories.

Basis did rebound dramatically by late November as freight weakened and bin doors closed. Now it’s time for elevators to lay out merchandising plans as 2015 approaches. Farm selling could easily remain light through early winter unless prices rise significantly. In turn, basis could firm more to keep bushels moving into the pipeline. And longer term, a lot of managers will focus on ways to better control their exposure to the recent wide fluctuations in freight costs and railroad performance.

Moral of the story

Whether every idea or suggestion turns out correct is less important than the planning process: taking the time to do some research, identifying factors and risks specific to this year, then standing back, and adding some contrarian thinking. The prevailing wisdom was that the 2014 harvest had to create massive problems; the reality is that a problem recognized early is often a problem avoided. Many of the challenges firms faced this year will be with us again in 2015; it’s never too soon to start thinking about those as well as new ones. Carryover stocks of corn and soybeans will be the largest in ten years in 2015, for example, which can impact summer basis and spreads. ❚

Hypothetical performance results have certain inherent limitations, and do not represent actual trading. Past results are not indicative of future outcomes. Trading futures involves risk of loss.

Subscribe to Magazine