"Corn is King” — at least in most states. The United States has raised 126 billion bushels of corn in the last 10 years; soybean and wheat production together total just 54 billion bushels. There are only a few major states where corn production falls short of wheat or soybeans: Montana, North Dakota, Oklahoma and Washington among them. Merchandisers and managers in most states consider corn their bread and butter and count on good returns each year from storage and drying revenue, along with basis appreciation. But returns on corn have been disappointing for many elevators this year, despite the 13.6B bushel crop.

Basis has been relatively flat in many markets for months, and shows negative returns since winter in some markets where production was largest. Many elevators have held onto hedged corn, waiting for basis to rise. After all, in years where supplies are plentiful, the market should pay a respectable carry! Maybe it should, but that doesn’t always happen. Then the flood of farm selling in April added to the long basis positions. Ethanol plants and other end users weakened their basis in response. Now, in May, managers are eying the calendar and debating whether corn basis will weaken or strengthen this summer. But with the clock ticking, waiting for basis to rise cuts your available shipping window, even while farmers have more corn to sell.

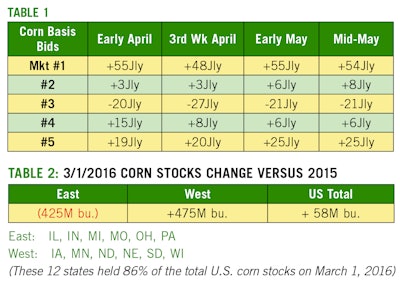

Here’s a recap of published spot corn bids for five markets on four scattered dates since early April. The markets include three ethanol plants, one river market, and one feedlot market. Two of the markets are in the West Corn Belt or Plains and the other three are in the East. I converted all bids to July futures using the May/July corn spread on the selected date(s).

The table shows that, so far, waiting since early April has produced minimal returns — if any. Some markets do show forward summer bids that are above interest costs; others do not. The best plan, in my view, is to get ahead of your competition; put offers in front of buyers and be ready to negotiate, whether or not you like the values. Even if basis does heat up later in the summer, many elevators would not be able to ship enough, fast enough, to clear out ownership before harvest arrives.

Summer basis will be influenced in part by each area’s March 1 corn stocks and projected Sept 1 carry-out stocks relative to other areas. The U.S. corn carryout this summer will be around 1.8 billion bushels, the largest since 2004 crop. March 1 (2016) corn stocks were 7.81 billion bushels, the largest since the CCC days back in the 1980’s, although not significantly larger than year-ago stocks. The additional bushels aren’t distributed evenly, however.

Corn production was hurt in areas east of the Mississippi River, while Western areas saw some record yields, which is reflected in the stocks. Although corn stocks are down this year in Eastern states, they’re still far above where March stocks were in 2013 after the short crop of 2012. This year Illinois, Indiana and Ohio alone had 650M bushels more corn on hand March 1 than three years ago. And several Eastern markets have brought corn trains in this year from the North Plains on special rail rates to bolster supplies. Other Eastern buyers were aggressive early on with strong summer (2016) bids that likely attracted a lot of forward purchases. There will be plenty of corn to go around this summer — even in the East — which doesn’t bode well for basis.

Takeaways from 2015 crop

Maybe your 2015 crop corn P&L isn’t terrific; that happens sometimes. After all, no one can force basis to rise, and the market doesn’t owe you a profit. The challenge then is to protect every possible cent of what is available.

Mike, the country elevator manager at a Corn Belt location, asked himself that question. “My corn P&L doesn’t look good so far, and I don’t see the summer getting better. What could I have done differently?”

Our answer to Mike would vary by market. One task is to always monitor forward basis values as closely as spot bids. Be sure you don’t automatically pass up selling and locking in good cash carries, assuming basis will be always be higher later.

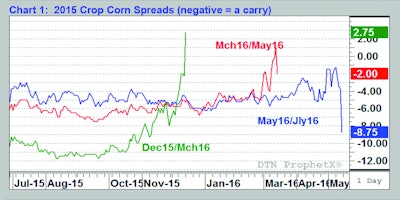

Another area that can make a big difference is futures spreads. Every extra cent you can lock in on a futures carry is an extra cent for your P&L. The interest cost to hold corn is barely over 1½¢/ month; anything a futures spread pays above that helps defray other out-of-pocket costs or goes to the bottom line. Learn how to calculate Financial Full Carry on futures spreads, which is the theoretical maximum. Map out your merchandising plan before harvest and identify which futures spreads will be important to that plan. December/March is a key spread for most elevators; few firms can sell and ship before December all the corn they buy at harvest. Winter purchases typically make March/May important as well, to give merchandisers time to continue to liquidate ownership.

Chart 1 shows three key corn spreads from 2015 crop. They show that the best carries for each spread occurred well before the delivery month arrived. The biggest carry on Dec15/March16 corn came in September of 2015, for example. Waiting until after harvest to “roll” short corn hedges was costly; nearly 8 cents of the carry had vanished by November. Setting March16/May16 in December of 2015 wasn’t the highest that carry traded, but at almost 7¢ it was close. May16/ July16 also hit its highest value in December of 2015, before narrowing 3 to 4¢. (Note: May/July collapsed on expiration day on 5/13/16 — far beyond the point hedgers needed to have rolled out of May futures.)

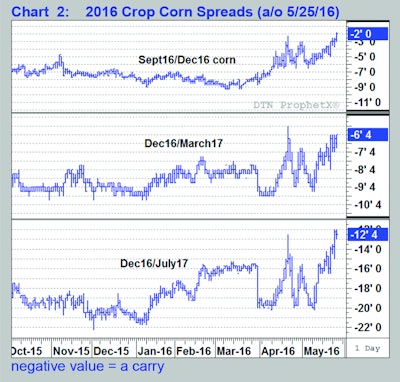

Chart 2 shows corn spread values for 2016 crop. None of them are especially attractive — barely 50% of Full Carry at their highest values so far. (Full carry on Dec16/March17 corn is about 17.3¢/bushel as of mid-May). Huge fund trading is impacting spreads in ag markets these days, where activity is typically concentrated in the first three to four futures months. (89% of all open corn futures contracts are in the first three months as of late May 2016.) At times, then, spreads can temporarily move contrary to market fundamentals, narrowing in the face of big stocks and another big crop, for example.

There is no crystal ball that will tell Mike or anyone else what day a spread will reach its highest carry or what that carry will be. Timing can vary year to year. But spreads are critical to a successful merchandising program, especially for “King Corn” where volumes are so large and clearing inventories takes months. Identify your holding costs, set spread objectives early, and have spread orders working. You might use Dec16/March17 at 11¢ carry as your starting objective, but review that weekly; circumstances change. Be willing to act when opportunity knocks. ❚