In the overnight session the grains traded higher with wheat up 4 cents, soybeans up 5 1/2 cents and corn unchanged going into the morning pause in trade. The U.S. dollar is trading down sharply this morning after retail sales revealed no growth in April. Crude oil is trading up 78 cents this morning.

Yesterday the USDA released its May WASDE report which had little effect on corn and wheat, but sent soybeans into a tailspin by the end of the day. Old crop soybean demand was revised higher by 20 million bushels to 350 million bushels after crushing and exports were increased by 10 million bushels each. The bullish old crop surprise was overshadowed by increased South American production and ominous new crop ending stock projections of 500 million bushels. The average trade guess expected new crop carryout to total 443 million bushels.

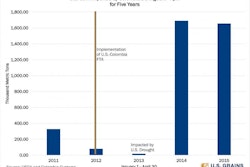

Old crop corn ending stocks increased 23 million bushels to 1.851 billion bushels which was shy of expectations. A 48 million bushel decline in feed and residual use was partially offset by a 25 million bushel increase in exports. New crop ending stocks were mostly on par with expectations with 15/16 carryout forecast at 1.746 billion bushels with a new crop yield pegged at 166.8 bushels per acre.

Ending stocks for old crop wheat were increased by 25 million bushels to 709 million bushels after the USDA bumped imports by 5 million bushels and slashed exports by 20 million bushels. Export pace has been softening recently with the last couple weekly reports showing cancellations totaling to 597,000 metric tons. New crop wheat ending stocks were forecast at 793 million bushels which was above expectations of 750 million bushels.

Global carryout for the 2015/16 marketing year looks to be higher than the expectations for soybeans and wheat. Global wheat ending stocks were pegged at 203.32 MMT up from 200.97MMT in 14/15 and above the average trade guess of 193.53 MMT. Global corn ending stocks are expected to hold mostly steady at 191.94 MMT compared to old crop carryout of 192.5 MMT. Global soybean carryout is expected to rise significantly to 96.22 MMT, above expectations of 95.17MMT and last years ending stocks of 85.54 MMT.