USDA and FDA Push Back on Export Requirement

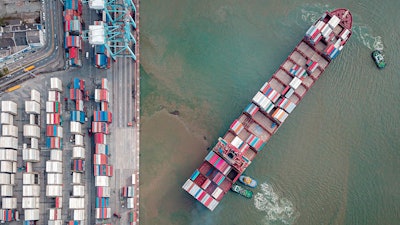

- Chinese customs officials are requesting soybean exporters sign declarations guaranteeing shipments are free of coronavirus.

- USDA and FDA issued a joint communication, stating in part; “Efforts by some countries to restrict global food exports related to Covid-19 transmission are not consistent with the known science of transmission,”

- Many American exporters have so far been reluctant to sign China’s affidavit for fear of liability.

- Tyson Foods became the first major US company to confirm it signed the certificate after China banned poultry exports from the firm.

FBN’s Take On What It Means: The question is whether the Chinese request is aimed at imposing trade restrictions to slow shipments to the country. To date, the requests are informal, and meant to ease Chinese consumer concerns over the safety of imported products. It appears most remain confident that China will refrain from unjustified measures on imported food.

Trade Expectations for US Acreage Update on Tuesday

- USDA will revise its acreage totals on June 30.

- The average trade estimate for corn acreage is 95.2 million acres versus USDA’s March forecast at 97 million.

- The trade sees soybean acreage at 84.7 million acres versus the March forecast at 83.5 million.

- Spring wheat acres are expected at 12.55 million, essentially unchanged from the March forecast.

- Durum planted area is expected at 1.3 million, also essentially unchanged from the March outlook.

FBN’s Take On What It Means: The corn expectations, while lower, would not be enough to pull prices substantially higher. On the other hand, the slightly higher bean outlook would probably not pull that market a lot lower either. Only slight changes for other spring wheat acres are expected, keeping it hard to get excited about wheat futures.

The risk of trading futures, hedging, and speculating can be substantial. FBN BR LLC (NFA ID: 0508695)