Economic forecasts have almost become as bad as politics. One set of forecasters is ready to call gloom and doom, while another suggests we are on the verge of new records in the equities markets.

One set wants to talk about the need for negative interest rates, while just a few months ago there were calls to raise rates.

Inverted yield curves would suggest a recession is around the corner, but at the same time, the country is running less than 4% unemployment.

Trade factors are an issue, with both imports and exports hit by our own or other country’s retaliatory tariffs. Middle East political troubles may drive oil prices higher, but that would provide a helpful shot in the arm to our own oil sector.

With so many conflicting signals, what can an economist say? Yogi Berra probably summed it up best: “It’s tough to make predictions, especially about the future.”

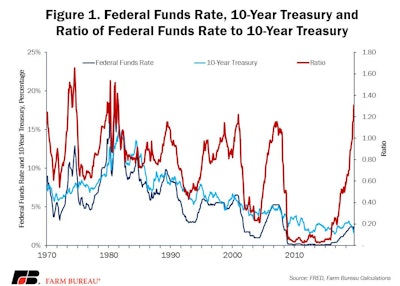

The inversion of the yield curve, discussed several times in past Market Intel articles, is often cited as a bellwether of upcoming economic downturns.

Over the last few months, that inversion has become more pronounced, even though the Federal Reserve lowered the federal funds rate. In August, the Fed dropped the overnight rate by 25 basis points, but the 10-year Treasury note dropped by 50 basis points.

The fed funds rate was down to 2.13% and the 10-year rate fell to 1.63%. This puts the ratio of the fed funds rate to the 10-year Treasury over 1.3. The last two times the ratio was that high was 1974 and 1981. For the 1974 event, the fed funds rate was 9.65%, with the 10-year rate at 6.74%.

To drive home how different this time is, the 1981 event saw the fed funds rate at – get ready, youngsters – 18.52% and the 10-year Treasury at 14.10%.

Reviewing these numbers puts the push by some for the Fed to lower interest rates further in a somewhat different perspective and raises the question of how much these ‘”high” interest rates are holding things back.

As we all know, consumer spending drives the general economy. Personal consumption expenditures account for over 70% of the gross domestic product.

Within that general category, however, are some things that change with the economic cycle and some that don’t. Consider your spending on food, energy, trips to the doctor or diapers.

The economy can go up or go down; you’re still going to eat, turn on your lights, go to the doctor and diaper your baby. Government spending, writ large in the sense of including federal, state and local levels, usually happens regardless of what goes on in the general economy.

These non-cyclical components of the economy will move up and down, but typically in a very small range.

The cyclical components of the economy include consumer spending on durable goods – you can put off buying a new car, for example, when economic uncertainty is high. It also includes business fixed investment, inventories, exports, and imports.

In the last quarterly report, those non-cyclical components of the economy added 3 full percentage points to GDP growth. At the same time, the cyclical components aggregated to an almost full percentage point drag. Imports, exports, and inventories are all linked to tariff policies, and thus it is not surprising to see weakness in these components. What continues to impress is a strong consumer attitude. As long as consumer spending holds up, most of these dire predictions should be viewed with a grain of salt.

With employment strong, and continuing wage growth, consumers are staying confident and are willing to spend. But if we start to see more significant layoffs driven in part by weak trade numbers or a major oil price increase, that attitude might change. Let the consumer get a little shaky, and things will likely descend rather quickly.

Bottom line, finance data is concerning, but given the level of interest rates, it may not be sending the same message as it was in the past. Further, consumers continue to be the engine that could. Without question, trade issues remain a source of potential trouble. Anyone working in a trade-related industry is probably going to work every day waiting for the other shoe to drop. If that worry starts to spread, it will become a very different story.

Contact: Bob Young, president, Agricultural Prospects

Email: [email protected]