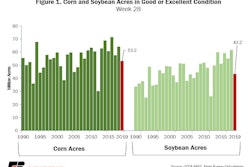

Weekly Crop Progress Report Shows 3.2 MA of Soy Acres Not Planted

In the weekly crop progress report released on Monday, the USDA’s soybean planting pace showed 4%, or 3.2 million of the estimated 80 million soybean acres are being unplanted.

This week was the final time that the USDA’s weekly crop progress report will include the planting pace for soybeans for the 2019 crop year.

The planting pace in the eastern corn belt and Missouri are the slowest on record.

The USDA lowered its planted soybean acres estimate for the 2019/20 crop year on June 28 by 4.6 million acres to 80 MA in the June Acres report.

During the first two weeks of July the USDA is resurveying soy producers about planted acres in 14 key states and will report any changes in the August WASDE.

What It Means for the U.S. Farmer: We believe that the slow planting pace in 2019 could be another wild card for the soybean complex. While the focus starts to shift to yields, we believe that the USDA resurvey of soybean acres during the first two weeks of July combined with the late reporting in the August WASDE has the ability to create a level of uncertainty about production estimates.

Black Sea Wheat Production: Ukraine Bumper Crop At + 16.5% YoY

India lowered import taxes on an additional 400,000 tonnes of corn to 15%, to help offset a rise in the price of animal feed in the country following last year’s drought.

India allowed imports of 100,000 tonnes of corn at the concessional tax rate in June.

The additional 400,000 tonnes of imports were permitted at the same rate following a request from the poultry industry.

India is the world's seventh-biggest corn producer and has import tariffs upwards of 60% on the grain. However, an infestation of the fall armyworm in 2017 combined with a drought in 2018 have reduced the country's corn output over the last two years.

India was a major exporter of corn to southeast Asia until falling output and increasing demand from poultry producers and corn starch manufacturers turned it into an importer a few years ago.

India does not allow the cultivation and imports of any genetically modified food crops.

What It Means for the U.S. Farmer: At FBN, we believe that the late arrival of the 2019 Indian monsoon has the ability to further stress Indian corn production. India’s import ban on GMO corn will reduce the role that the U.S. plays in exporting to the country.

The risk of trading futures, hedging, and speculating can be substantial. FBN BR LLC (NFA ID: 0508695)