Slaughter rates are returning to near normal and weekly beef and pork production is exceeding year ago levels, but it wasn’t that long ago that consumers were emptying grocery store shelves and processing facilities were closing due to labor and COVID-19 issues – leading to daily dire predictions of meat shortages in the U.S.

The self-distancing and quarantine protocols put in place to slow the spread of COVID-19 reduced economic growth, shuttered consumers in their homes and changed the way Americans purchase and consume food. Food production, too, was significantly disrupted, especially at livestock processing facilities, where labor shortages and worker protection measures slowed throughput at plants around the country and even caused some facilities to shut down.

Now, just a few short months later, the story has shifted to one of potential oversupply, soft demand and a (relative) return to normal in terms of the volume of product moving through the system.

Slaughter Near Year-Ago Levels

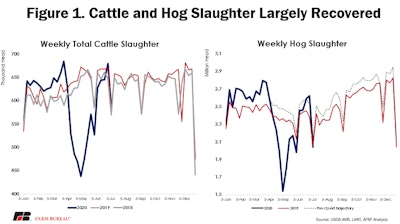

Due to COVID-19-related labor issues, slaughter facility capacity dropped sharply in April and May. At its worst in early May, cattle slaughter dropped 35% from 2019 and hog slaughter dropped 35% from the previous year. Slaughter capacity has largely recovered to near normal levels -- more quickly than most in the industry anticipated. We are by no means out of the woods yet and face a large backlog of animals in the system that will remain with us through at least the early fall. Fed cattle slaughter has settled around 95% of full capacity, but this may be the most that the industry can accomplish given the measures put in place at facilities to combat the spread of COVID-19.

Hog slaughter has returned to above 2019 levels and is mostly in line with its pre-COVID-19 trajectory. Maintaining these higher slaughter levels will be critical to working through the backlog of animals. This is particularly true of the pork complex, as previous USDA hog and pig reports indicate a larger volume of animals in the pipeline for later in the summer, meaning there may not be much room at slaughter facilities to clear additional animals that have backed up. The breeding decisions that resulted in this larger volume were made long before the impacts of COVID-19 could be imagined.

Animal Weights Are on the Rise

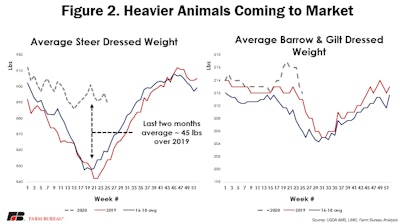

As the backlog of animals in the system forces producers to hold on to animals longer, they continue to gain weight before moving to slaughter. This has resulted in an increase in live and dressed weights of animals in the supply chain, creating a problem with cattle carcass weights. As evidenced in Figure 2, cattle carcass weights tend to seasonally decline and bottom out in late spring, then rebuild to a peak in October or November. This year, carcass weights have mostly held steady throughout the summer because of the slowdown of throughput at the plants the last few months and the backlog of animals that slowdown created in the country’s feedyards.

Over the previous two months, dressed steer carcass weights have averaged approximately 45 pounds over 2019 weights. These above-average carcass weights will likely be with us for several more months before returning to their normal pattern. Hog carcass weights have not been affected to the same degree as cattle, but we still have seen an uptick in carcass weights for market hogs. The developments in animal weights leads us to our next point, the resulting increase in meat production.

Beef and Pork Production

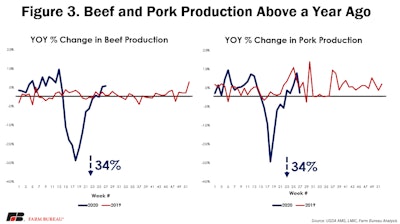

The increase in carcass weights has led to an increase in beef and pork production, pushing production levels above 2019 these last few weeks. During the worst of the plant closures, beef and pork production had fallen to 34% below 2019 levels. Now that slaughter has largely recovered, the heavier carcass weights will keep beef and pork supplies above 2019 for the immediate future as we work through the backlog of animals.

The conversation around the beef and pork complexes has largely shifted from a story of supply to a story of demand. Now that the 4th of July has passed, one of the larger demand events of the summer for meat is behind us. Seasonally, the next few months of summer tend to see slower beef and pork consumption and lower prices than early summer when consumers, excited about warmer weather after winter, fire up their grills. However, with many restaurants still closed and others reclosing around the country, higher-than-normal meat demand could occur at the retail sector as consumers continue to be stuck at home. With many food service businesses forced to reclose due to spikes in COVID-19 infections, softer demand for middle meats, which are more exposed to the foodservice and restaurant sector, could continue through the summer. The reopening – or not -- of schools and colleges this fall will also introduce uncertainty into institutional/food service meat demand. These institutions typically start procuring product for the fall in the late summer, but the rising uncertainty around COVID-19 infections has injected more uncertainty into these demand channels.

Summary

The beef and pork complexes have considerably moderated from the extreme price swings and supply chain disruptions that occurred throughout much of the last several months. The excessive carcass weights will continue to drive beef production higher, with levels exceeding where they were a year ago. However, as we move into the fall, we will likely see higher fed and feeder cattle prices as the incredibly light placements from this spring become slaughter ready. Animals are still largely backed up through the system, but healthy margins in the processing sector will hopefully incentivize packers to attempt to aggressively pull animals through the system and work through the backlog.

Contact: Michael Nepveux, Economist

(202) 406-3623